Ticker: ENR

Price: 115.30 EUR

Target: 160 EUR –> Achieved on 11/02/2026 (around +39%)

Company Overview

Siemens Energy is a global energy-technology company operating across power generation, grid infrastructure, and industrial decarbonization.

Originally part of Siemens AG, the company includes the former Gas and Power division of Siemens AG and has full ownership of Siemens Gamesa, which operates in the wind power industry. Siemens AG remains the largest shareholder with a 10% stake, a figure which is declining over time.

The group is structured into four segments:

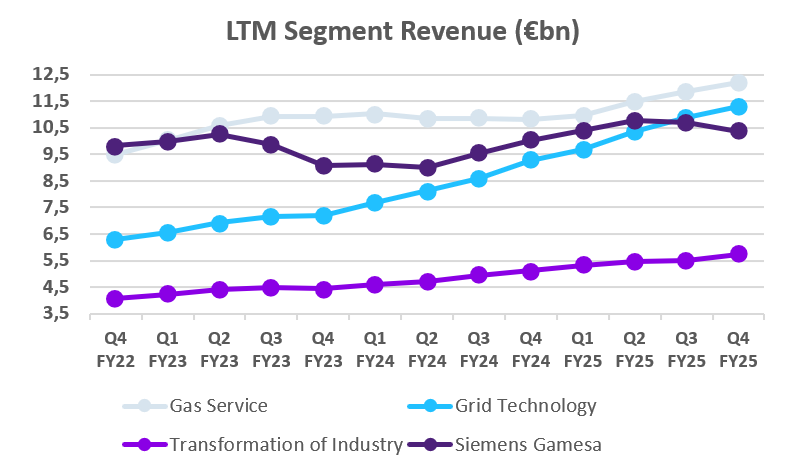

- Gas Services (30.8% of FY25 revenues) supplies gas and steam turbines and provides long-term service to a large installed base; it is the company’s most profitable segment, delivering a 13% margin in FY25 with a clear trajectory toward 18–20% by FY28.

- Grid Technologies (28.5% of revenues) manufactures high-voltage transmission systems, transformers and digital grid-stability solutions; it is the fastest-growing and structurally strongest division, with margins expanding from 15.8% in FY25 to 18–20% by FY28 on the back of exceptional demand from utilities and hyperscalers.

- Transformation of Industry (14.5% of revenues) provides electrification, industrial efficiency and decarbonization solutions, spanning electrolysers, industrial turbines and generators, compressors, drives and digital services. The division has completed a successful turnaround, reaching an 11.3% margin in FY25 and targeting 12–14% by FY28.

- Siemens Gamesa (26.2% of revenues) remains loss-making at –13% in FY25 but is progressing along its restructuring path, with management expecting break-even in FY26 and 3–5% margins by FY28.

Regionally, EMEA grew 14.4% YoY and represents 53% of group revenues, while the Americas grew 16.3% and now account for 31%.

The U.S. delivered positive growth (+25.3%), driven by accelerating demand for gas turbines and grid infrastructure to support rising electricity consumption from AI and cloud-driven data centers. This demand translated into a sharp increase in volumes: gas turbine shipments nearly doubled YoY and Grid Technologies more than doubled sales to hyperscalers, reflecting unprecedented investment in HVDC links, transformers and grid-stabilisation equipment.

Collectively, Gas Services, Grid Technologies and Transformation of Industry generate more than 100% of the group’s operating profit, while Siemens Gamesa remains the only segment dragging consolidated margins.

Industry Overview

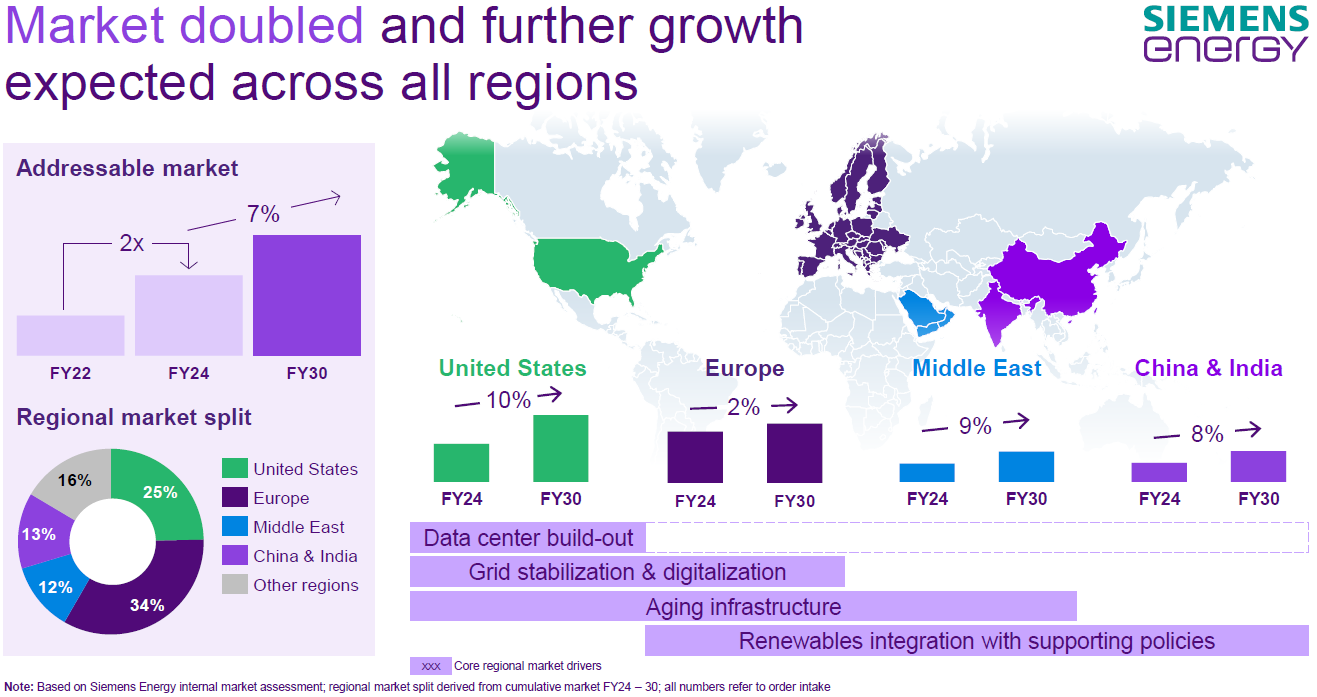

The global power sector is undergoing a structural shift as electricity demand accelerates sharply, led by hyperscale data centers and AI workloads. These loads create unprecedented pressure on both generation and grid infrastructure, turning the current capex cycle into a non-discretionary, multi-year investment phase. Despite rapid renewable deployment, natural gas remains the only flexible and scalable source of firm power for at least the next decade, a view reiterated by Siemens Energy’s CEO at the latest Capital Markets Day. After decades of underinvestment, grid operators now face structural bottlenecks, driving record demand for HVDC systems, large converters, transformers and grid-stability equipment.

The competitive landscape in high-voltage grid technology is relatively concentrated. The five leading global players: Hitachi Energy, Siemens Energy, GE Vernova, ABB and Mitsubishi Electric, control an estimated 50%-60% of the market for HVDC infrastructure, high-capacity converters and large power transformers. This segment is experiencing a pronounced supply-demand imbalance, with long manufacturing lead times, constrained global capacity and limited availability of qualified engineering resources. These dynamics structurally favour incumbents with global manufacturing footprints, long-standing customer relationships and the ability to execute multi-year, capital-intensive projects.

By contrast, the Grid Automation segment, which includes ADMS platforms, protection systems, sensors and distribution-level monitoring, is far more fragmented and local. Barriers to entry are lower, competition is broader, and pricing power is correspondingly weaker. Although still capital-intensive, this part of the market does not exhibit the same bottlenecks or supply constraints affecting high-voltage transmission equipment.

Our constructive view on Siemens Energy is rooted in this industry backdrop: a multi-year, highly visible investment cycle driven by the company’s core exposure to gas turbines, high-voltage grid technologies, and industrial electrification, areas where structural demand strongly outpaces global supply.

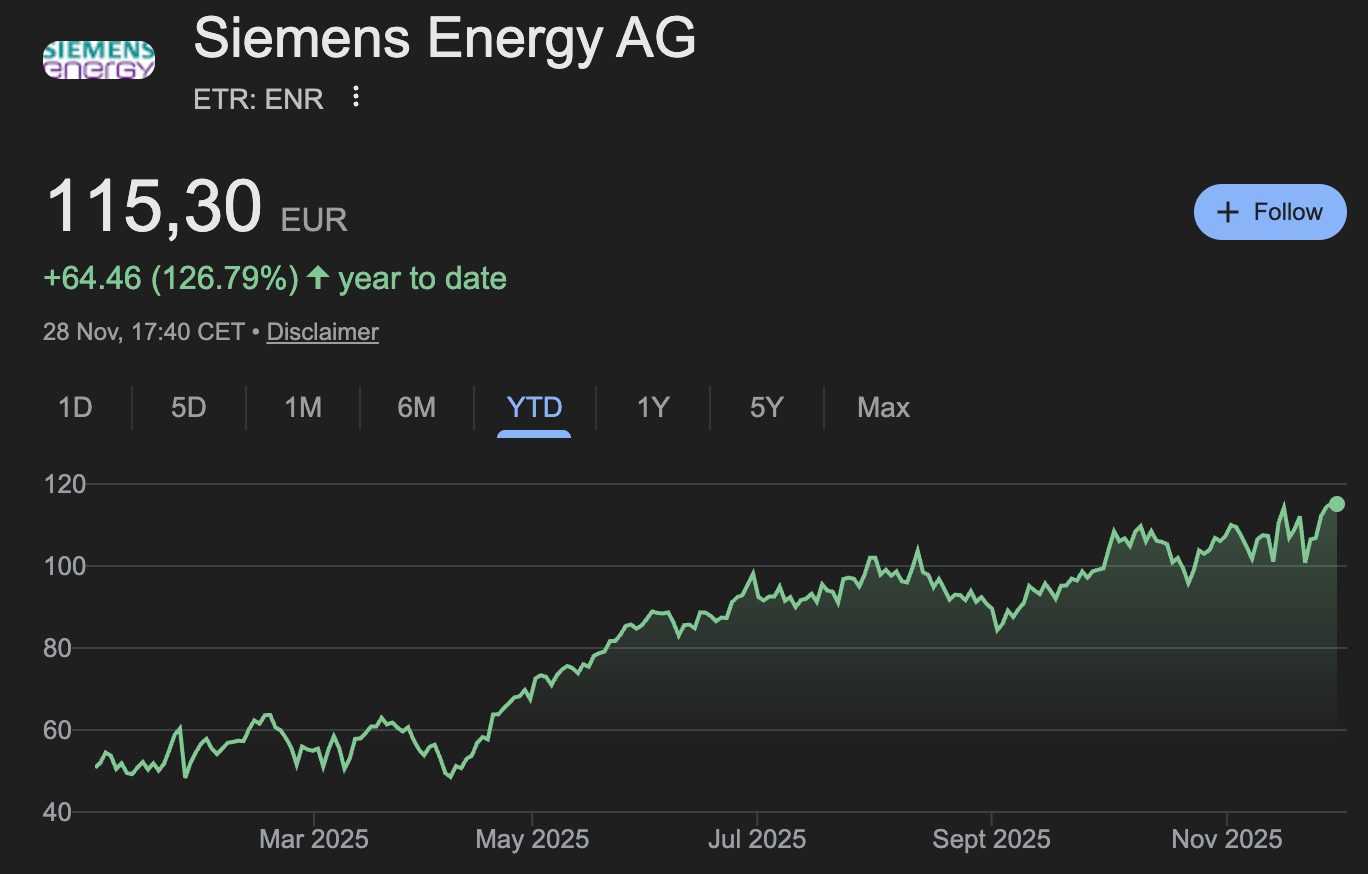

Recent Share Price Performance

Siemens Energy has delivered a strong equity performance year-to-date, with the stock up approximately +127%, materially outperforming both European industrial peers and the broader market. The rerating has been driven by a combination of improving fundamentals and a significant reduction in perceived tail risks.

Investors have responded positively to a visible inflection in profitability across Gas Services, Grid Technologies and Transformation of Industry, combined with an exceptionally strong demand backdrop linked to AI-driven electricity consumption. The rapid normalization of free-cash-flow generation has further improved confidence in the reshaped financial profile, while the reiterated turnaround roadmap at Siemens Gamesa, with break-even expected in FY26 and a return to positive profitability by FY28, has removed the main structural overhang on the equity story.

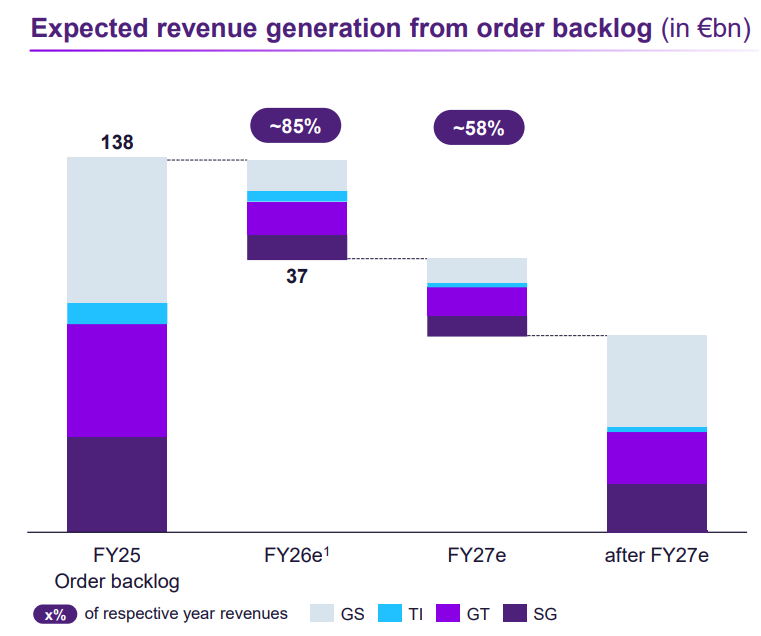

The substantial backlog visibility, covering 85% of FY26 revenues and nearly 60% of FY27, has further supported the multiple expansion, as the business model shifts toward higher-margin, long-duration service revenues and more selective order intake.

While the stock’s strong YTD performance reflects improved fundamentals, we believe the market is still underestimating the duration and resilience of the current capex cycle, particularly in gas turbines and high-voltage grid infrastructure.

Financial Risk

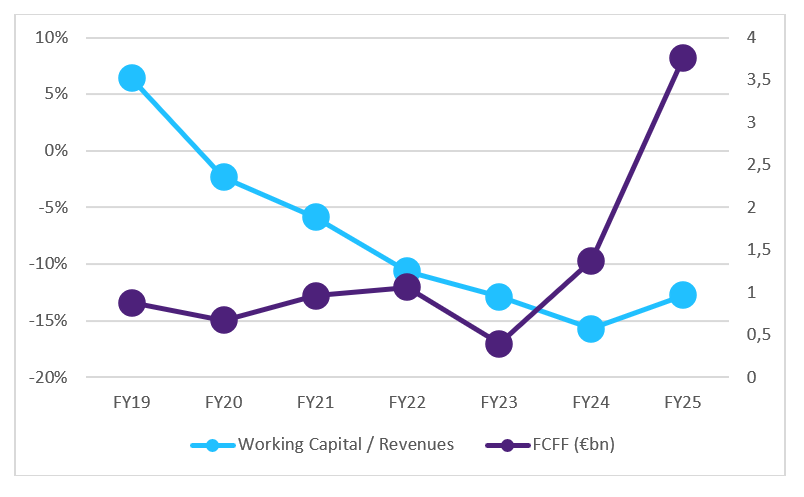

Siemens Energy enters FY26 with a distinctly stronger financial profile than in previous years. After a prolonged period of cash absorption driven by Siemens Gamesa’s operational issues, the Group has now restored a healthy cash-generation pattern. Free Cash Flow improved from just €394m in FY23 to €1.4bn in FY24, and further to €4.1bn in FY25, supported by margin expansion in Gas Services, Grid Technologies and Transformation of Industry, and by structurally high customer prepayments across long-cycle infrastructure projects.

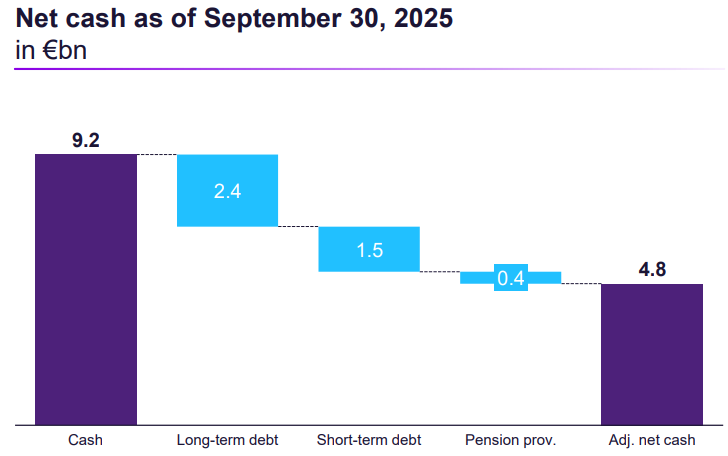

The deleveraging has been substantial. Siemens Energy moved from a net debt position of €193m in FY23 to an adj. net cash position of €4.8bn in FY25, driven almost entirely by the sharp rebound in Free Cash Flow and the unwinding of Gamesa-related contingencies. Net Debt / EBITDA now stands at –1.5x, providing ample balance-sheet flexibility and fully eliminating the refinancing concerns that overshadowed the stock in 2023.

With the restoration of strong cash generation, the German Federal Government lifted Siemens Energy’s dividend restriction in June 2025. The restriction had been imposed in 2023 as part of the counter-guarantee tied to a bank guarantee facility supporting Siemens Gamesa. With that facility refinanced ahead of schedule, the counter-guarantee and the dividend ban were terminated.

The company’s dividend policy (40–60% payout) is now fully reinstated, enabling a material capital-return programme. Management plans to distribute up to €10bn through FY28, roughly 12% of current market cap, combining €4bn in dividends and a €6bn buyback authorization. This marks a structural shift in Siemens Energy’s financial profile: capital returns are restarting, leverage is negligible, and the balance sheet has become a source of optionality rather than a constraint.

Despite an improved solvency, Siemens Energy’s average cost of financing is 7.6%. While a higher cost of financing is typically normal for project-based companies, Siemens Energy is being negatively affected by previous solvency weaknesses. The company originally was rated BBB by S&P in 2020, but then was downgraded to BBB- in July 2023 as the company withdrew its profit guidance due to Siemens Gamesa weaknesses. In May 2025 S&P Global updated its outlook from stable to positive, and we expect the overall cost of financing of Siemens Energy to continue to decline as solvency and cash generation improves.

The Free Cash Flow generated by Siemens Energy is inherently volatile as the company benefits from an increase in Advanced Payments as the order backlog increases, as can be seen from the Working Capital / Revenues ratio decreasing and going into negative territory. However, this implies that in the event of a slowing backlog, the Free Cash Flows will decline. This is in part compensated by Service Revenues, which now account for roughly 40% of the order book and will provide stability to future cash flows as Siemens Gamesa and Gas Turbines segments grow.

Given the accelerated order intake we’re seeing across the Gas Service and Grid Technology segments, we are currently in an expansion phase, and the risk of declining cash flows due to order normalization is not meaningful in the short-to-medium term.

Outlook

On an aggregated level, Siemens Energy’s revenues are expected to grow in the low-teens at least until FY28. This is consistent with the sector’s growth estimates and with Hitachi Energy’s guidance of 13-15% provided in their 2024-2030 business plan.

The management has great visibility on the guidance provided, as 85% of FY26 revenues and 58% of FY27 revenues are already secured through the existing backlog, significantly reducing the risk of a topline miss.

We expect the company to continue growing at similar or higher rates beyond 2028, as gas remains effectively the only reliably scalable source of electricity until 2035. Other energy sources, such as nuclear power and renewables, might contribute significantly once they start producing, but in most cases this can take almost ten years.

As Alan Duong (Head of Data Center Design, Engineering & Construction at Meta) said during Siemens Energy’s latest Capital Market day held on November 20th, “you can’t find land and you can’t find energy anywhere today”. Technology companies are competing in the AI race, and no technology company can afford to wait 10 years to power their data centers.

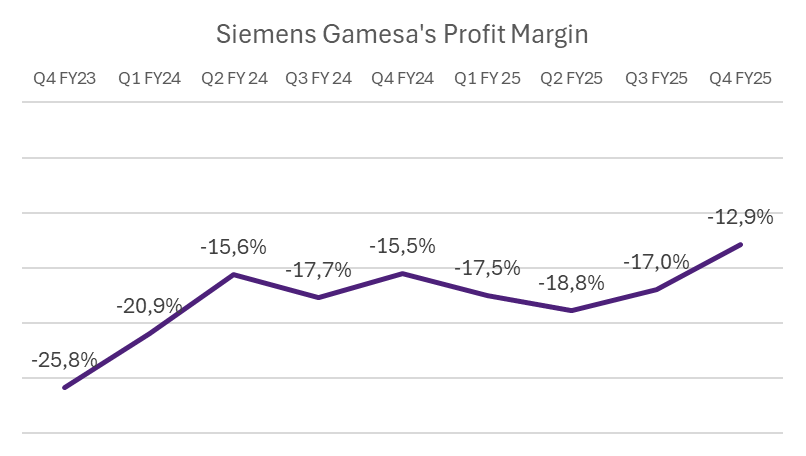

For each installed gas turbine, Siemens Energy unlocks long-term, recurring service revenue thanks to the 20-year-long cycle of service. To put things in perspective, as of November 20th, the installed gas turbine fleet had a capacity of 78 gigawatts, which will unlock up to $30bn in service revenues in the next 20 years. At the end of September, the installed capacity was only 70 gigawatts, meaning the installed capacity increased by 11.4% in the last six weeks.

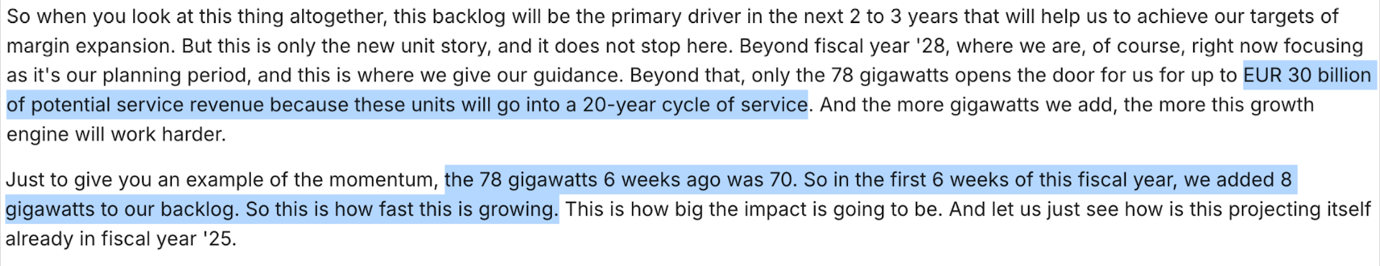

Profitability margins are also expected to drastically increase, from an aggregated 6% profit margin before special items in FY25 to 9-11% in FY26 and 14-16% in FY28, effectively more than doubling profitability in just three years. This will be achieved by optimizing cost structure and, most importantly, being selective on what orders to fulfil.

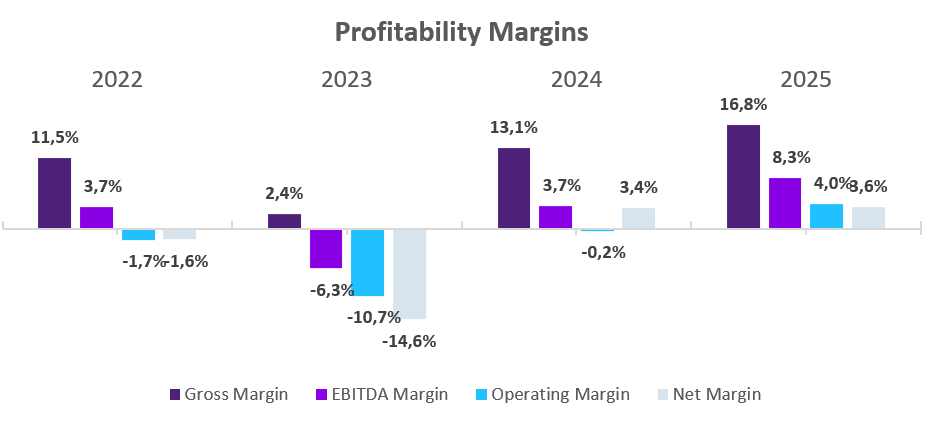

Since FY23, Siemens Energy’s profitability has been heavily affected by the performance of Siemens Gamesa. The onshore 4.X and 5.X platforms exhibited manufacturing and design defects that generated abnormally high failure rates. These issues required substantial warranty provisions, remediation programs and the temporary halt of commercial activity on the 5.X platform.

The combination of component failures, quality-related charges and under absorption in factories pushed Gamesa’s margins deep into negative territory, amplifying the negative profitability of an already competitive and loss-making wind industry.

As shown below, quarterly margins, while still negative, are now gradually improving, supporting management’s target of breakeven FY26 and positive profitability of FY28.

After conducting lengthy quality reviews, Siemens Gamesa temporarily halted sales of certain onshore models in 2024, removed third-party suppliers responsible for the faulty components, and has effectively entered a restructuring. Due to the long-term nature of contracts, negative effects persisted in 2025, but the management is expecting to reach breakeven in FY26 (with negative profitability margins in H1 FY26 turning positive in H2).

To achieve this objective, the company is focusing on more profitable geographical areas (recently selling the Indian wind business), being more selective on order intake to ensure positive profitability, while negative effects from faulty components gradually fade away.

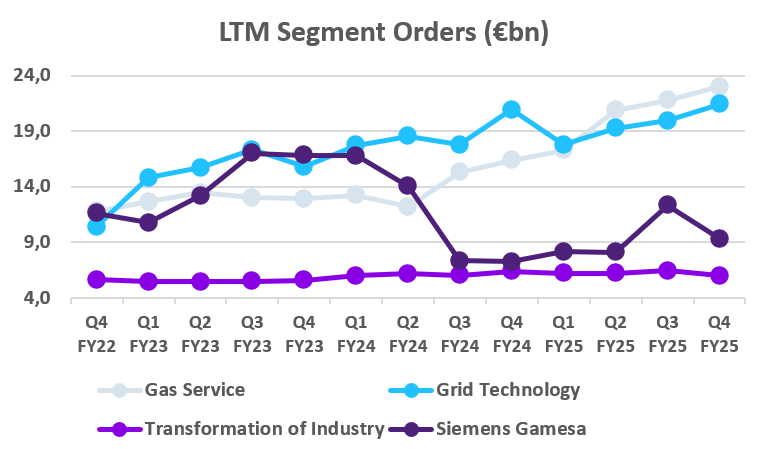

The book-to-bill ratio reached 1.51 in FY25 vs 1.46 in FY24, driven by an increase in the book-to-bill ratio of Gas Services (1.89 vs 1.52). Grid Technologies’ ratio decreased from 2.25 to 1.90 but remains largely above one, ensuring the revenue target provided by the management is achievable.

Being able to not only maintain but also to increase the book-to-bill ratio while at the same time improving profitability (by being selective not to take less profitable orders) shows how strong the underlying demand for data centres is.

Forward-looking valuation & catalysts

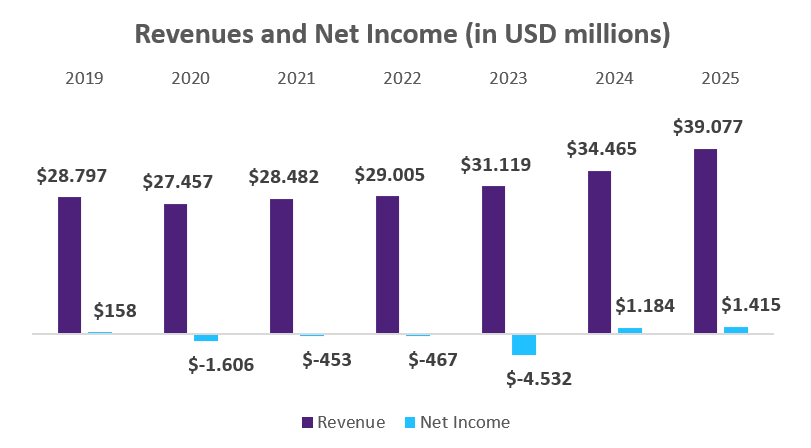

From 2019 to 2023, Siemens Energy delivered only 2% revenue CAGR and operated with structurally depressed margins, largely due to Siemens Gamesa’s operational issues and legacy low-margin contracts. As a result, historical multiples reflected the profile of a slow-growing, capital-intensive company.

The backdrop today is fundamentally different. AI-driven electricity demand, structural grid undersupply and a sharp inflection in gas-turbine orders have pushed Siemens Energy into a new growth regime. Revenue CAGR for FY26–28 is expected to exceed 12%, six times the historical rate, while margins expand toward the mid-teens, supported by high-visibility backlog and a growing share of long-duration service revenues. In our view, guidance is conservative. Management itself notes that a meaningful portion of prospective orders from hyperscalers is not yet included in the FY28 outlook, providing further optionality.

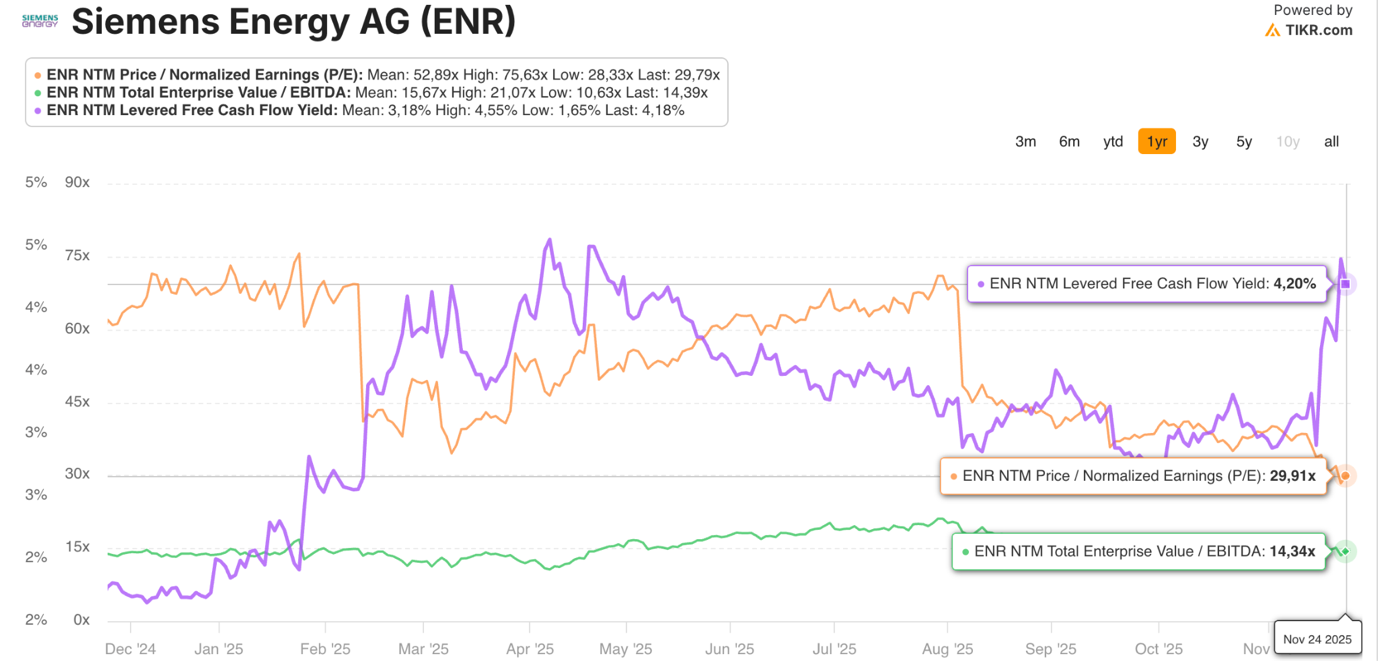

On valuation, Siemens Energy trades at 29.8x NTM P/E and 14.4x NTM EV/EBITDA, levels that appear elevated only when compared with the 2019–23 period, which is no longer representative of the business. Given the structural earnings inflection, we believe the stock should be valued on normalized FY28 earnings, rather than on backward-looking multiples distorted by Gamesa’s losses.

Even if we simply hold today’s valuation constant and apply the current 30x P/E to FY27 EPS of €4.83, the implied fair value already falls in the €140–145 range. This upside does not assume any multiple expansion and is driven almost entirely by earnings power. That said, with EPS compounding at more than 30% annually through FY28, the stock effectively trades on a PEG ratio well below 1x, a signal that the market may still be underestimating the duration and quality of Siemens Energy’s structural earnings cycle, particularly the long-dated, high-margin service revenues enabled by the rapidly expanding gas-turbine installed base.

In our view, the management’s guidance is likely conservative.

Backlog visibility beyond FY28 remains limited, yet sector dynamics suggest that orders could continue to accelerate: electricity demand from AI and hyperscale data centers is rising faster than grid operators can respond, and industry participants, including Meta’s Head of Data Center Engineering, have stated that the race for AI capacity will be won in the next two years. Both CEO Bruch and CFO Ferraro continue to signal confidence, repeatedly highlighting multi-year demand visibility and a pipeline of opportunities not yet embedded in current guidance.

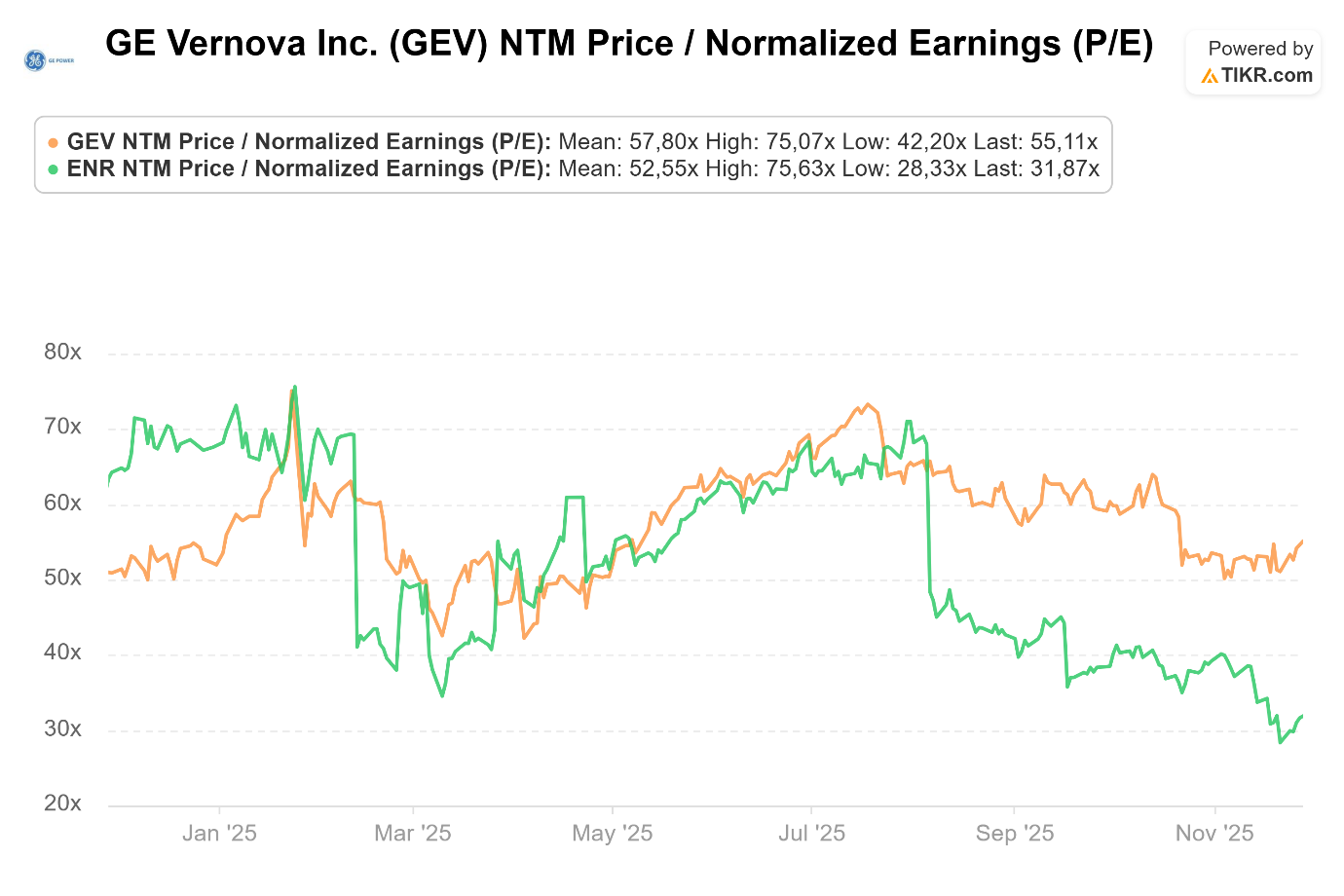

Siemens Energy trades at a discount compared to peers like GE Vernova which trades at 55x NTM P/E, which can be partly explained due to Siemens Energy’s current lower profitability. However, with the expected improvement in profitability led by Siemens Gamesa restructuring and profitable expansion in other segments, we believe there is room for a multiple expansion. The decrease in cost of debt will also reduce the cost of capital, which will further justify a positive rerating. For these reasons, we believe Siemens Energy’s intrinsic stock price to be in the range of €150-€170 per share, or a 40% increase from current prices.